Social Security Contributions – Size Matters!

What, when, where, how much? – more about social security (download article)

Payment of social security contributions are mandatory for all European employers. As the payable amounts vary from country to country, it is not unimportant in which country your employees are covered, as you might be faced with an unforeseen liability.

3 TYPES OF EMPLOYEES TO CONSIDER IN REGARDS TO SOCIAL SECURITY CONTRIBUTIONS IN EU

Being in a cross-border business or having employees working in more countries than one entails certain requirements. One of these is social security.

In which country an individual is covered by social security depends on the circumstances in question. Within EU/EEA and Switzerland a distinction must be made between:

- employees working in one country

- employees working in two countries or more and

- employees, who are seconded

3 SITUATIONS THAT DECIDE THE SOCIAL SECURITY CONTRIBUTION’S DOMICILE IN EU

All three situations are governed by the main rule that an individual can only be covered in one country.

- The main rule is that an individual is covered by social security in the country of the workplace.

- If the work is carried out in two countries or more, the individual is covered in the country of residence, provided that more than 25% of the work is carried out there. If that is not the case, the individual is covered by social security in the country in which the employer has their place of residence.

- If an employee is meeting the requirements for being stationed abroad, i.e. working abroad for a period not exceeding 24 months (two years) and not replacing another stationed employee, the social security coverage can remain in the country in which the individual normally works.

Consider a person who resides in Denmark and primarily works in Denmark and Sweden, and occasionally in other countries as well. If the employee is able to carry out work in Denmark for more than 25%, it is possible to keep the social security coverage in Denmark.

Remember to always obtain an A1 certificate documenting the social security coverage of your employees when carrying out work in other countries. Should an accident occur whilst being on a work-related travel, the employer’s casualty insurance may not apply.

WHY IS IT POTENTIALLY INTERESTING TO KEEP SOCIAL SECURITY IN DENMARK?

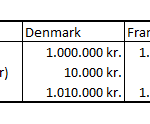

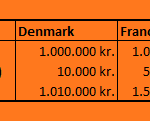

In Denmark there is a fixed total contribution, ranging between DKK 6.000 to DKK 10.000 per employee. In comparison, Norway, Sweden and France have contributions varying depending on various elements like industry, job status, level of remuneration etc. Below is an example illustrating the social security contribution’s impact on the payable amount from an employer perspective (all figures are estimates).

Facts:

- When being inside of the EU, EEA or Switzerland, you can only be covered by social security in one country.

- When carrying out work in another country than your usual working country or in more countries than one, it is mandatory to obtain an A1 certificate documenting that you are covered by social security in another country.

- In 2016, Denmark was ranked 20th in OECD’s Tax Wedge comparison report.

Download Article

![]()

Contact us

[pirate_forms]