(article below video | Download article Changes To The Danish Inbound Tax Regime 2018)

Changes to the Danish Expat Tax Regime 2018

6 steps to consider on how to include Payroll Department

The extension of the stay period and a change in the tax rate for the inbound expats are the new black in the Danish Tax Regime. Does this call for the Payroll empowerment?

Basic change and impact

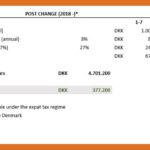

From the 1st of January 2018 the rules on the Danish Expat Regime have changed. Basically, inbound expats are now able to stay in Denmark for 7 years rather than 5 at the low, flat tax rate. In order to finance the extension, the rate of taxation has been increased from 26 % to 27 %. On the other hand, it results in a less net of pay for all expats on the regime (see the example below).

As from the 1st of January 2018, these changes affect not only the newcomers, but also every individual currently included in the expat regime.

Why should you involve Payroll Department when adapting the change

– employers are now liable

First and foremost, keep in mind that starting from 2018, employers are now liable for the content of the individuals’ year-end statements. This means, that for employees under the Expat Tax Regime (see criteria below), the taxes shall also be settled via Payroll. Thus, the employer is now being responsible for the lack of compliance in the employee’s tax declaration. As such, inclusion of the Payroll Department in these processes is crucial to clarify risks and management of such, because…

“… the Payroll Department is effectively preparing the tax returns for every employee,

including inbound expats.”

To include the Payroll Department, we recommend the following steps:

- Provide Payroll with the necessary knowledge of the inbound expat assignments

- Consider the relevant compliance measures which shall be undertaken by Payroll and Tax

- Secure that the Payroll changes the tax rate from 26% to 27% on the pay slips/HR system

- Evaluate, if the period of stay for the current expats should be extended and communicate it to Payroll

- Request an analysis from Payroll in respect of the key payroll related implications of the inbound expat assignments

- Join the forces of Tax, HR and Payroll with the purpose of understanding every aspect of the assignments

We are able to assist in all of the above – please do not hesitate to contact us.

[pirate_forms]